FINANCE, BUSINESS

Monday, 28 February 2022

Two Pot System

Understanding the Two Pot System in a Defined Benefit Pension Fund

The Two Pot System is a recent retirement reform designed to provide employees with greater flexibility and access to their pension savings. This system, which divides retirement contributions into two distinct "pots"—a savings pot and a retirement pot—has stirred interest and questions, particularly for members of defined benefit pension funds like the Government Employees Pension Fund (GEPF).

The GEPF operates as a defined benefit pension fund, meaning retirement benefits are calculated based on a formula that considers an employee's Years of Service, Age, and Average Final Salary. Here’s a closer look at how the Two Pot System functions within a defined benefit framework, what it means for GEPF members, and the questions that remain unanswered.

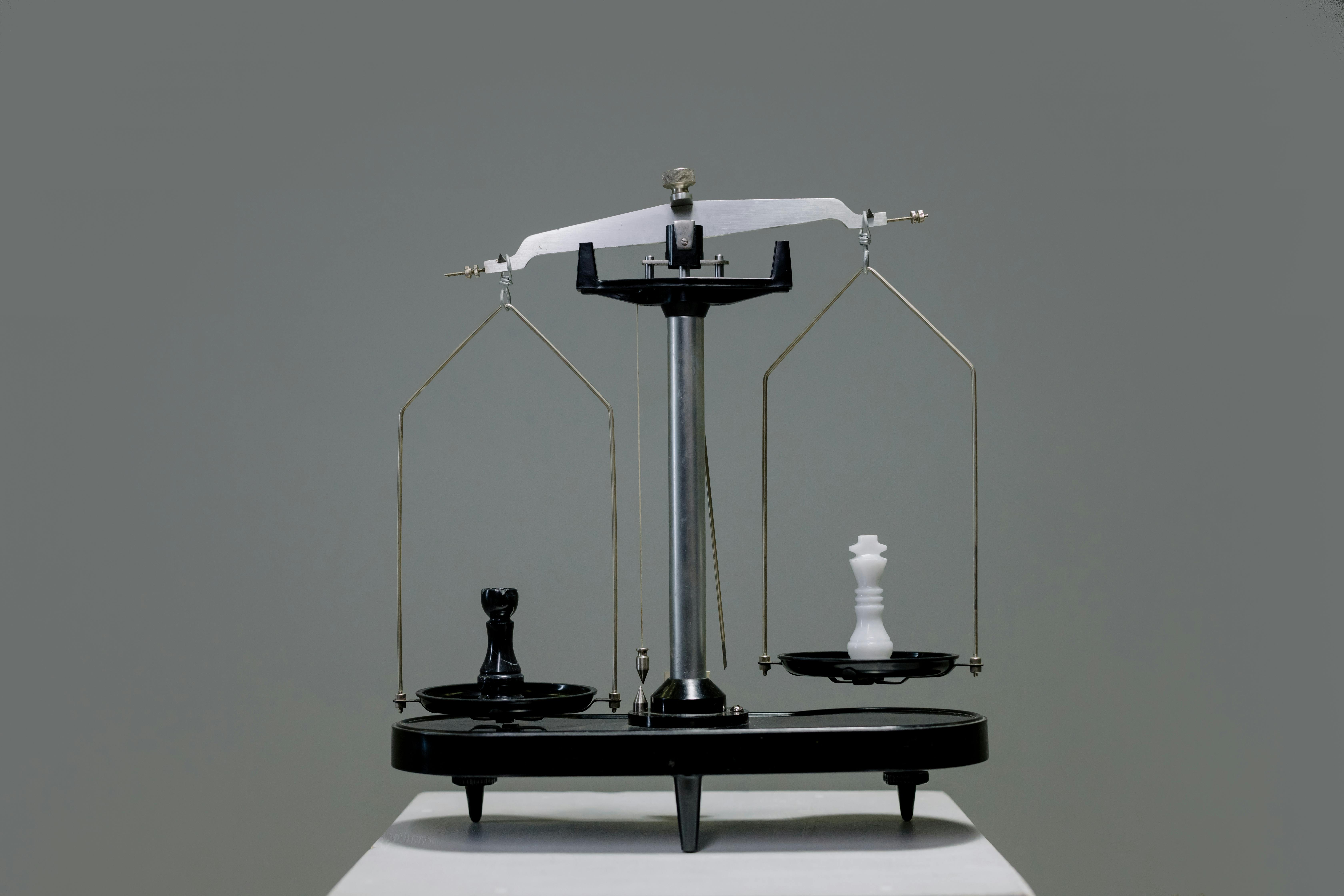

The Two Pot System: Savings and Retirement Pots

Under the Two Pot System, retirement contributions are split into two components:

1. Savings Pot: This portion is designed to provide more immediate access to a portion of retirement savings. Members can withdraw from this pot before formal retirement, with certain restrictions.

2. Retirement Pot: The remaining portion is reserved exclusively for retirement and cannot be accessed until the member reaches retirement age.

To seed the savings pot, an initial investment amount—referred to as seed capital—is required. This seed capital is calculated as the lesser of 10% of the member’s vested interest or R30,000. For defined benefit funds like the GEPF, this calculation must derive from the member’s actuarial interest, a measure of the member's accrued benefit value as determined by actuarial formulas.

Defining Seed Capital: Which Formula Will Be Used?

The GEPF has indicated that the seed capital (or 10%) will be calculated based on the member's actuarial interest. However, the exact formula for determining this 10% within the GEPF framework remains unclear. Typically, defined benefit funds use different methods to calculate actuarial interest, and GEPF members might wonder which specific formula will apply. Here are three possible calculation methods, each with potential implications for members’ seed capital:

1. Years of Service-Based Formula: In this approach, the actuarial interest could be calculated primarily by factoring in the member’s years of service. This would potentially favor long-serving employees, whose contributions over time increase their accrued benefit value.

2. Final Salary-Based Formula: Another possible approach is to calculate the actuarial interest based on the member's final salary. This method would prioritize high-earning employees, as their final salary typically plays a significant role in defined benefit calculations.

3. Combined Formula (Service, Age, and Final Salary): A third option—and one commonly used in defined benefit calculations—is a comprehensive formula that incorporates years of service, age, and final salary. This approach provides a balanced measure, accounting for the length of service, earnings, and retirement proximity, making it a likely candidate for the Two Pot System.

Key Considerations for GEPF Members

With the Two Pot System’s implementation, GEPF members face some important considerations regarding how their benefits will be structured and accessed. Here are a few questions and concerns:

1. Which Formula Will Apply?

○ The GEPF has not yet clarified which formula will be used to determine the 10% for the seed capital. Members should seek further guidance on how actuarial interest will be calculated under the Two Pot System to better understand what portion of their benefits may be accessible early.

2. Flexibility vs. Future Security

○ The Two Pot System aims to provide flexibility through the savings pot, but members should be cautious about accessing these funds early. Withdrawing funds from the savings pot may reduce the overall amount available for

retirement, so careful planning is essential.

3. Defined Benefit Complexity

○ Because defined benefit pensions like the GEPF are based on set formulas rather than investment account balances, implementing a Two Pot System within this framework can be complex. Defined benefit plans traditionally don’t lend themselves to early withdrawals or flexible access, so members should stay informed about how GEPF will address these challenges.

Final Thoughts: Preparing for the Two Pot System

The introduction of the Two Pot System represents a significant change in how GEPF members can interact with their pension funds. For now, the exact impact remains uncertain, particularly regarding how the 10% seed capital will be calculated. However, by staying informed and understanding how actuarial interest factors into defined benefit calculations, GEPF members can be better prepared to make the most of this new structure when it goes into effect.

As GEPF continues to release updates, members should keep in close contact with their human resources representatives or financial advisors to ensure they make well-informed decisions about their retirement. Clarity on the formula will be crucial to allow members to fully leverage the benefits of the Two Pot System while safeguarding their retirement future

GET IN TOUCH

Deal Activities

University of Natal (Durban): Workshops on Worker Finances for COSATU in KZN.

South African Post Office: Retirement Fund Member Communication and Financial Literacy

Individual Clients: Personal services ranging from individual business assurance, investments, retirement funds and medical aid

Thekwini Business Development Centre (TBDC): Wealth Planning workshop for the historically disadvantaged employees.

Africa Vukani

078 457 0964

(031) 100 1017

9 Dorothy Nyembe Street

(Gardener Street)

Durban Central