LAW

Friday, 15 November 2024

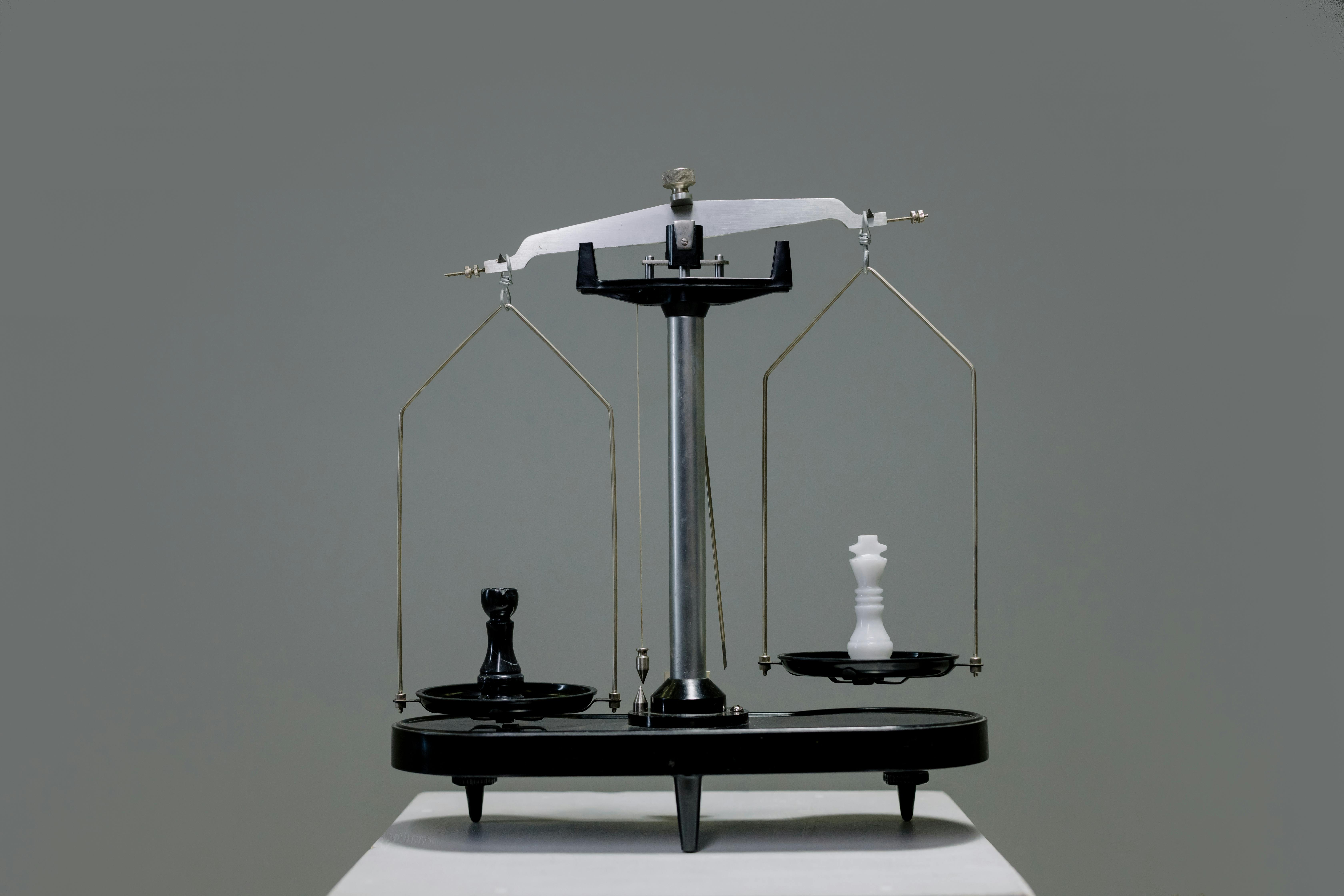

Divorce Changes

Divorce Law Amendments in the GEPF: Understanding Pension Interest and Its Implications

When the Government Employees Pension Fund (GEPF) amended its divorce laws in 2012 and 2019, it introduced the concept of Pension Interest for divorce settlements. While the term itself seems clear enough—referring to a member's benefits on the date of divorce—the calculation method behind it remains opaque. Over a decade later, members and their advisors are still left with critical questions. Which formula is being used to calculate Pension Interest, and why has the GEPF not amended its rules to provide a clear, definitive formula?

Facts: Key Issues in the Calculation of Pension Interest

The legislative updates to the divorce section of the GEP Law in 2012 included the term Pension Interest as an essential part of calculating benefits in divorce settlements. However, neither this amendment nor the subsequent 2019 revision provided an actual formula for Pension Interest calculations, leaving members with significant uncertainty about how their benefits are calculated.

● 2012 Amendment: The introduction of Pension Interest was a major change in the calculation of divorce settlements, yet no formula was given in the rules to define how this amount would be calculated.

● 2019 Amendment: The rules were revisited but still did not include a formula for Pension Interest. This continued absence of clarity has raised questions among members, who deserve to understand how their benefits are calculated during a divorce.

This lack of transparency makes it challenging to determine which resignation formula, if any, the GEPF is using to calculate Pension Interest. The missing formula leaves divorcing members without essential information needed to understand the financial impact of their divorce settlements.

Legislative Changes: Multiple Definitions of Pension Interest

The GEP Law, Schedule 1 (Fund Rules), and the GEPF Membership Guide each define Pension Interest slightly differently. This lack of consistency further confuses the issue, as members do not know which definition applies in practice:

1. GEP Law: The law defines Pension Interest as “benefits to which a member would have been entitled if their membership were terminated on the date of divorce.” 2. Schedule 1 (Fund Rules): It defines Pension Interest as the “lump sum cash benefits which the member would have been entitled to if they had resigned on the date of divorce.”

3. GEPF Membership Guide: In the membership guide, Pension Interest is simply defined as the resignation benefits on the date of divorce.

These definitions leave members and their advisors wondering which interpretation applies, as each definition could imply a different method of calculation. The question remains: which formula is the GEPF using to calculate Pension Interest, and why has it not provided a unified explanation in the fund rules?

Education: Critical Questions for Divorcing Members

The implications of these ambiguities are profound. Members undergoing a divorce must consider several questions about how their Pension Interest is determined, and whether it reflects their best interests. Key considerations include:

1. Awareness of Resignation on the Day of Divorce

Does the divorcing member fully understand that their Pension Interest is calculated as if they resigned on the date of divorce? In many cases, members might not be aware that this assumption underpins their divorce settlement calculations. It effectively assumes the member's resignation without actually requiring them to leave their position.

GET IN TOUCH

Deal Activities

University of Natal (Durban): Workshops on Worker Finances for COSATU in KZN.

South African Post Office: Retirement Fund Member Communication and Financial Literacy

Individual Clients: Personal services ranging from individual business assurance, investments, retirement funds and medical aid

Thekwini Business Development Centre (TBDC): Wealth Planning workshop for the historically disadvantaged employees.

Africa Vukani

078 457 0964

(031) 100 1017

9 Dorothy Nyembe Street

(Gardener Street)

Durban Central